Opening Rip

Explosive bullish momentum setup occurring in the first 15-30 minutes after market open at 9:30 AM ET, characterized by rapid price expansion with strong volume and breadth confirmation

A comprehensive collection of proven NQ futures day trading setups. Each play includes detailed setup conditions, chart examples, and extensive historical precedents to help you recognize and execute these patterns effectively.

Explosive bullish momentum setup occurring in the first 15-30 minutes after market open at 9:30 AM ET, characterized by rapid price expansion with strong volume and breadth confirmation

Early session reversal setup when price direction diverges from advancing-declining issues breadth, signaling institutional distribution or accumulation in the first 15-20 minutes

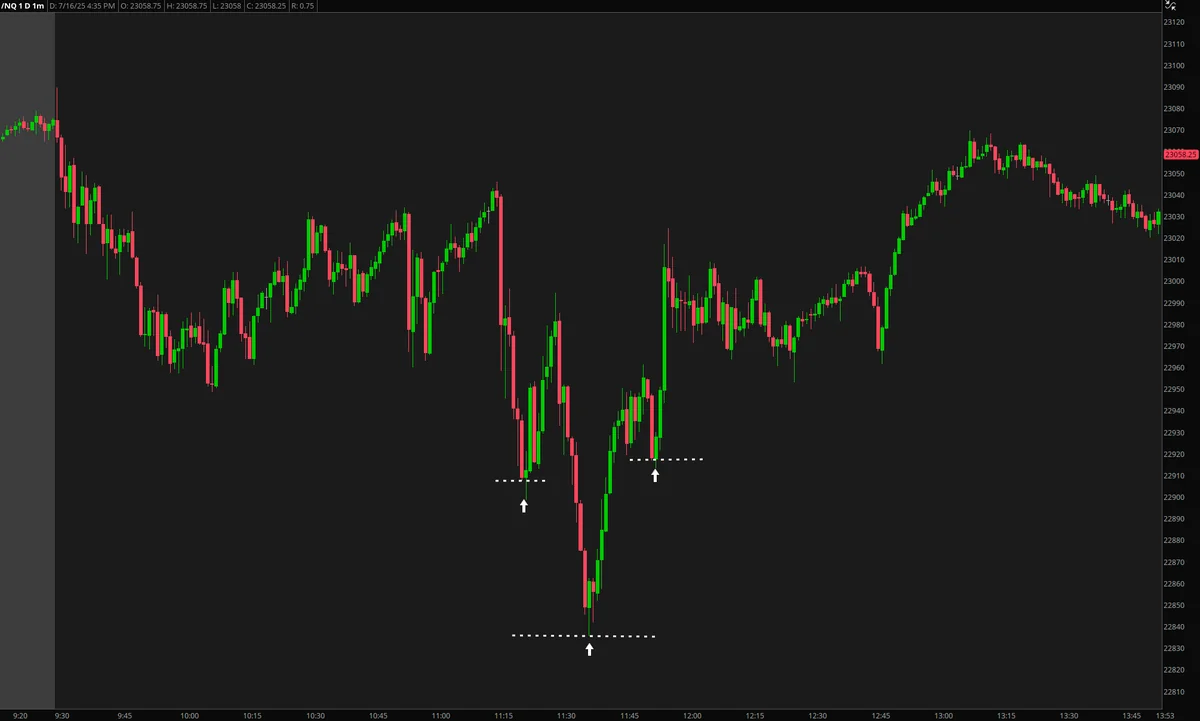

Long setup when price drops sharply but fails to break recent lows, consolidates with a higher low, then breaks out bullishly

Short setup when NQ gaps up significantly (+1%) in premarket but forms lower highs, then aggressively drops at market open with strong selling pressure and negative TICK confirmation

Long setup for NQ when price forms inverse head and shoulders pattern at key support levels with Triple AO Wave Rider buy signals

A short setup where price fails to break above a key resistance level while market breadth deteriorates, signaling distribution and potential downside.