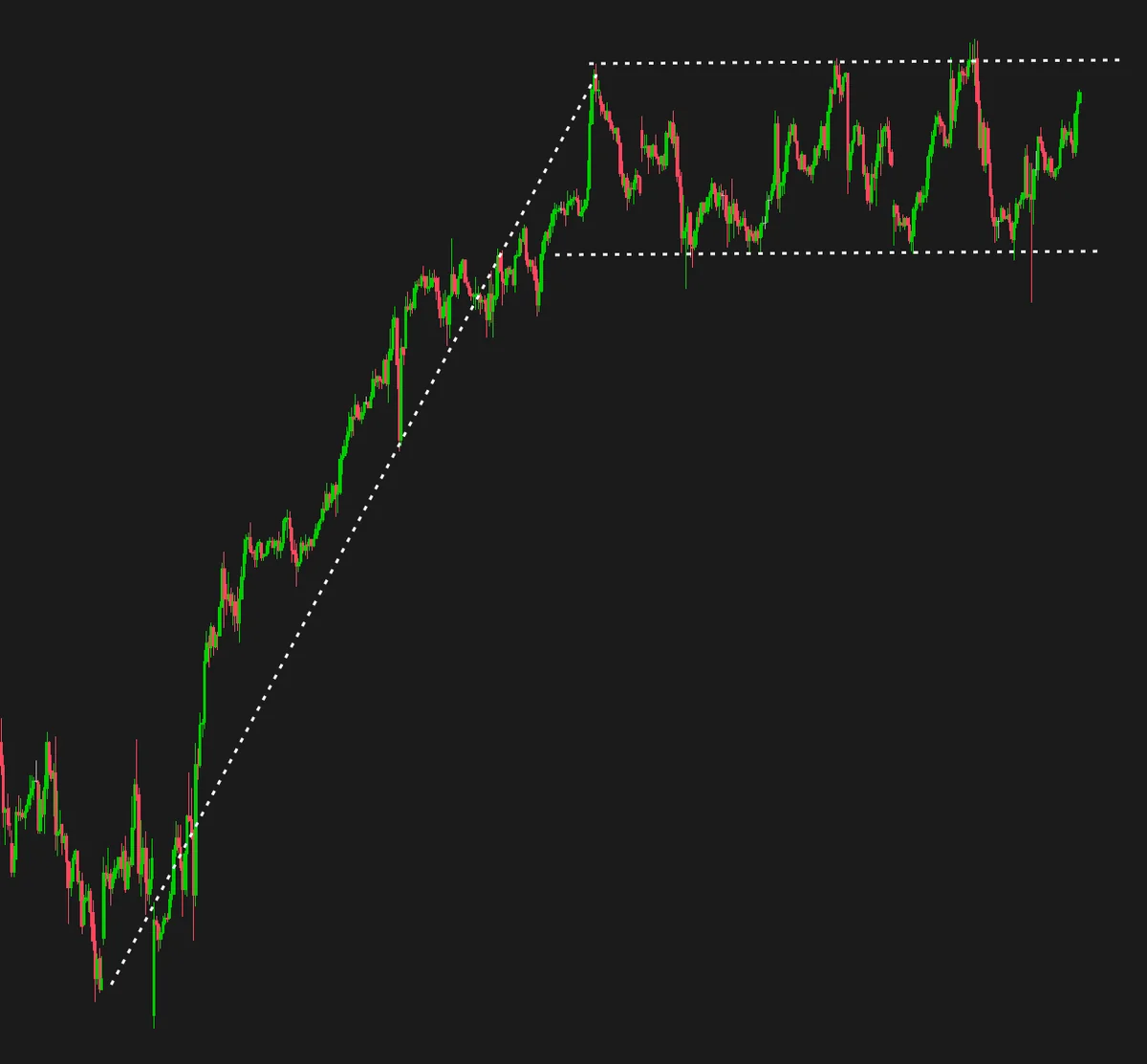

V-Shaped Recovery in NQ Sets Up All-Time High Test at 23,847

When NQ hit 22,800 support, sellers thought they had control - but Monday's Opening Rip changed everything. Now we're staring at a V-shaped recovery targeting all-time highs.

Stay updated with real trading insights, market analysis, and proven strategies from professional day trading. Our insights cover practical trading experiences, market setups, and educational content to help you improve your futures trading performance on NQ, ES, and RTY.

When NQ hit 22,800 support, sellers thought they had control - but Monday's Opening Rip changed everything. Now we're staring at a V-shaped recovery targeting all-time highs.

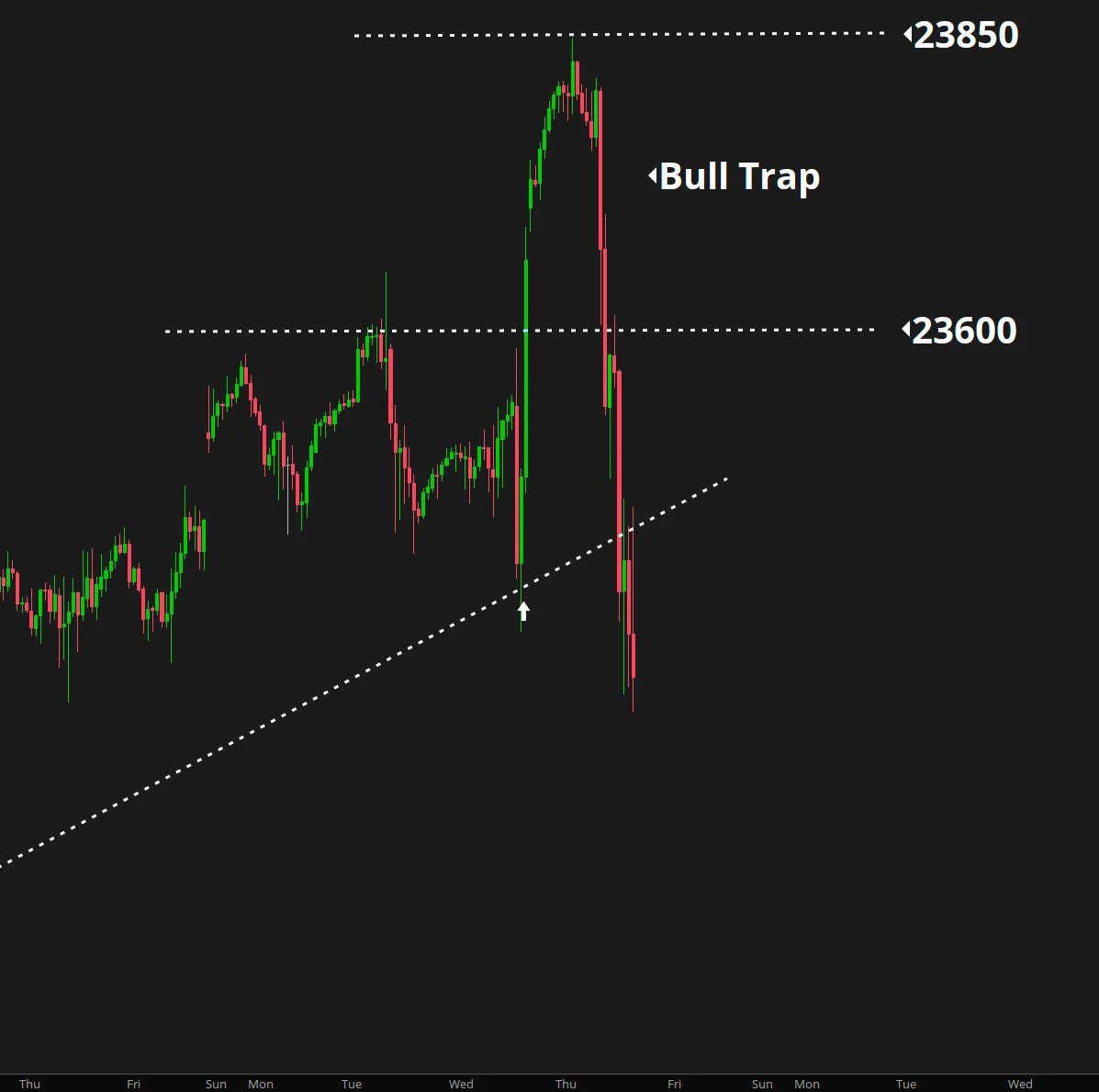

MSFT and META earnings created the perfect bull trap, and now NQ sits at a critical juncture - will 22800 channel support hold, or are we headed for a deeper correction reminiscent of 2000?

NQ futures reversed sharply today despite stellar MSFT and META earnings, creating a textbook bull trap as institutional sellers overwhelmed retail buyers at the open. Breaking below 23,600 support and yesterday's lows, this technical breakdown at weekly resistance sets up a crucial test for early August.

When the Fed speaks, markets often whisper - but today, they screamed. What started as a classic Fed day drift turned into one of the most explosive reversals we've seen all year.

When former resistance becomes support AND a bull flag forms on lower timeframes, smart money takes notice. ES is showing exactly this setup right now.

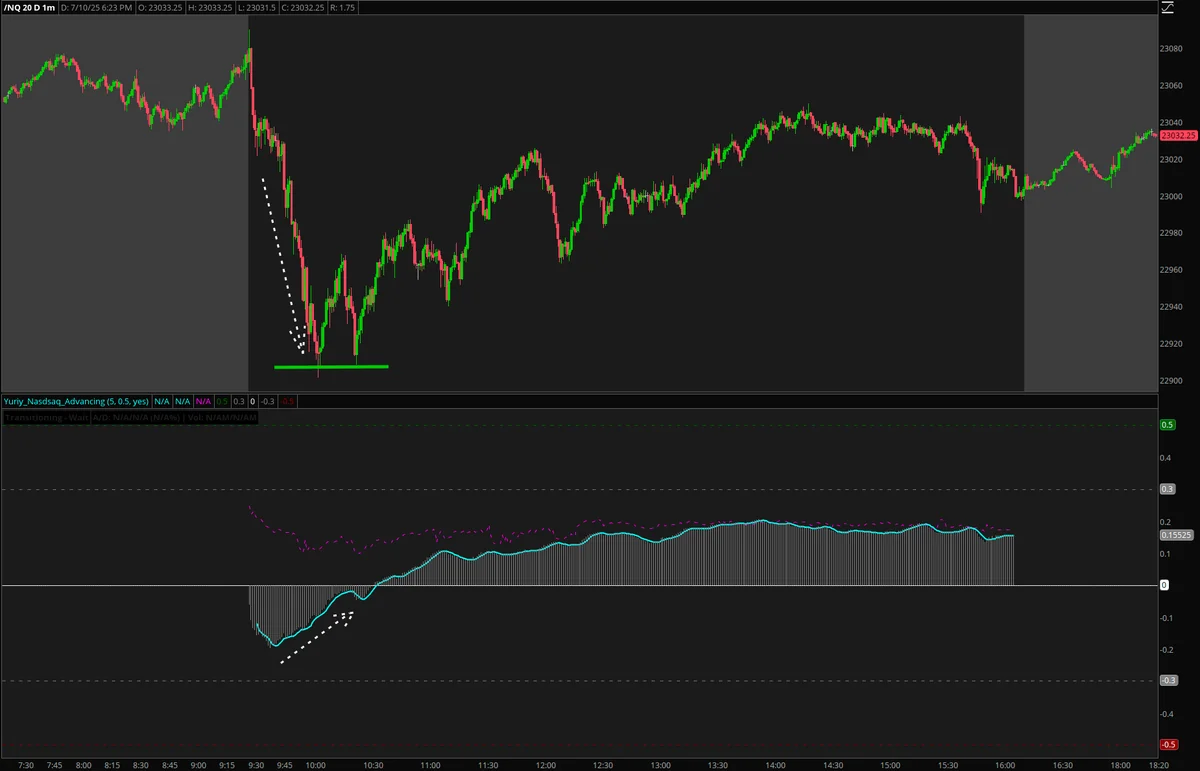

While the NQ dipped to 23072 support after the open, smart money was already positioning for the bounce - and the advancing-declining issues indicator showed exactly why.

Sometimes the best trades come when price action says one thing but the internals tell a completely different story.

Pre-market showed strong momentum, Triple RSI confirmed the setup, and position scaling maximized the profits. Here's how Wednesday's morning session delivered textbook scalping success.

While most traders avoided Monday's NQ weakness, contrarian dip buyers spotted the perfect setup. Here's how market breadth indicators revealed the hidden opportunity.