Setup Example

Setup Recognition

Core Divergence Pattern

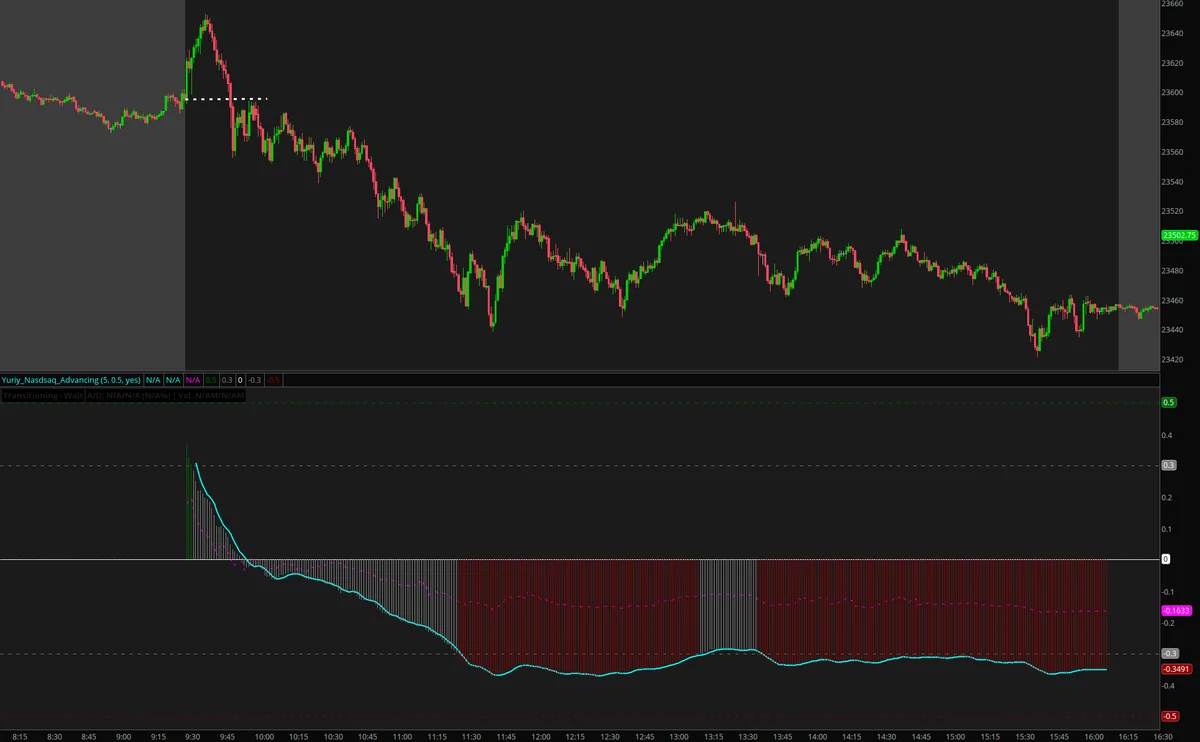

The setup occurs when price action contradicts market breadth during the crucial opening 15-20 minutes, revealing institutional activity that opposes surface price movement.

Bearish Reversal Scenario

- Price Action: NQ rallies from the open, showing apparent strength

- Breadth Signal: Advancing-declining issues are deteriorating (more stocks declining)

- Interpretation: Institutional distribution occurring beneath surface strength

- Expected Outcome: Downward reversal as selling pressure overwhelms initial buying

Bullish Reversal Scenario

- Price Action: NQ declines from the open, showing apparent weakness

- Breadth Signal: Advancing-declining issues are improving (more stocks advancing)

- Interpretation: Institutional accumulation occurring beneath surface weakness

- Expected Outcome: Upward reversal as buying pressure overwhelms initial selling

Critical Timing Window

The 15-20 Minute Edge

This setup’s effectiveness comes from acting within the first 15-20 minutes when:

- Initial algorithmic trading creates deceptive price direction

- Institutional orders are actively being executed

- Most retail traders follow price rather than underlying breadth

- True market sentiment hasn’t yet been fully reflected in price

Execution Strategy

Entry Criteria

Enter positions when:

- Clear divergence between price and breadth is established

- Still within the critical 15-20 minute timing window

- Price action confirms the reversal direction:

Long Entry (Bullish Reversal)

- NQ showing weakness but advancing issues improving

- Enter when price moves above the open after the initial dip

Short Entry (Bearish Reversal)

- NQ showing strength but declining issues increasing

- Enter when price starts dropping below the open

Key Success Factors

| Factor | Description |

|---|---|

| Divergence Recognition | Quickly identifying when advancing-declining issues move opposite to price direction |

| Timing Precision | Acting within the critical 15-20 minute window when divergence has maximum predictive power |

| Institutional Flow Reading | Understanding that breadth often reveals institutional activity before it’s reflected in price |

| Directional Flexibility | Being prepared to trade in either direction based on the divergence pattern that develops |

The Morning Reversal setup provides traders with a systematic approach to capturing early-session reversals in both directions by reading the divergence between surface price action and underlying market breadth, offering high-probability entries based on clear price-level triggers regardless of market direction.

Historical Precedents

Below are 2 historical examples of this setup occurring in NQ futures. Each example shows the setup formation and execution.