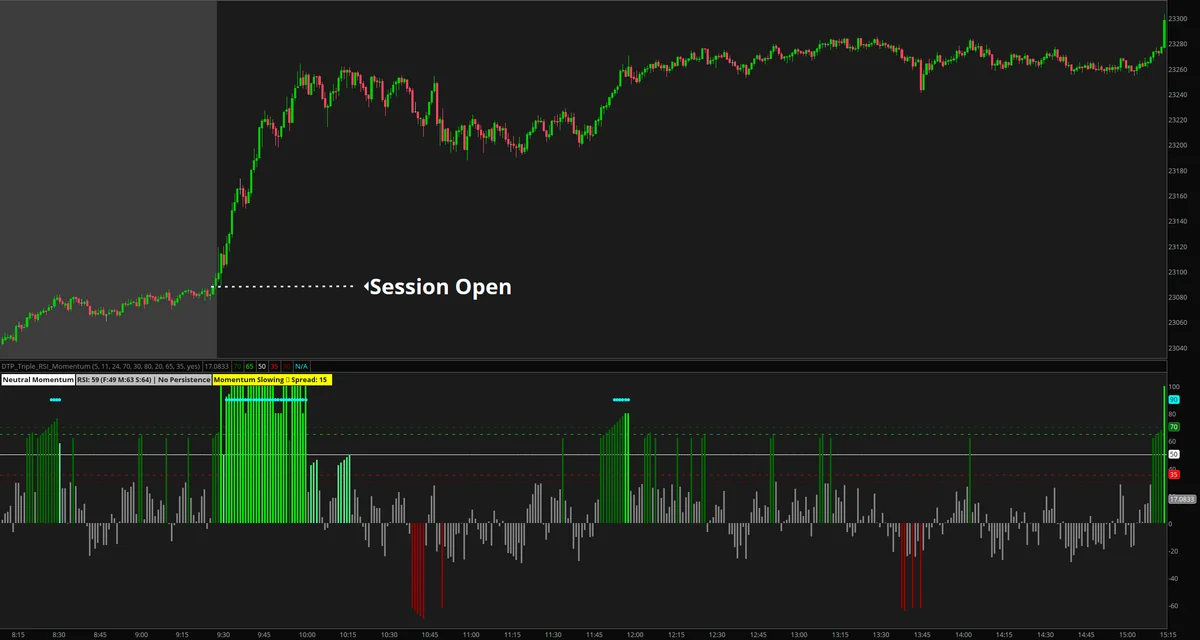

Setup Example

Setup Recognition

Pre-Market Indicators

The Opening Rip setup begins forming before the market opens. Look for these pre-market signals:

- Futures trading significantly above previous day’s close (0.5%+ for NQ)

- Strong pre-market volume compared to average

- Positive overnight news or earnings catalysts

- Pre-market high continuing to push higher into the open

The 9:30 AM Explosion

At exactly 9:30 AM ET when the cash market opens, watch for these immediate confirmations:

- Price surges higher within the first 1-2 minutes

- Volume spikes to 2-3x average opening volume

- No hesitation or choppy action - clean directional move

- Breaks above pre-market high quickly (within 5-10 minutes)

Critical Timing Elements

The First 5-Minute Bar

The opening 5-minute bar tells you everything about the setup’s validity:

- Bullish Close: Must close near its high

- Range Expansion: Should be one of the largest 5-min bars

- No Lower Wick: Little to no selling pressure visible

- Volume Confirmation: Highest volume bar of pre-market and open

The 15-30 Minute Continuation Window

After the initial explosion, the next 15-30 minutes determine if this is a sustainable rip:

- Price should NOT break below the opening 5-minute bar low

- Each pullback should be shallow (less than 30% of the move)

- New highs should be made within 15-20 minutes

- Volume remains elevated compared to average

Entry Strategies

Strategy 1: The Immediate Entry

For aggressive traders who can recognize the setup instantly:

- Enter within first 2-3 minutes if all signals align

- Use the pre-market low as initial stop

- Scale in on first minor pullback

- Highest risk but captures the full move

Strategy 2: The First Pullback Entry

For conservative traders who want confirmation:

- Wait for first pullback after initial surge

- Enter when price bounces off opening 5-min bar high

- Tighter stop below the pullback low

- Lower risk but may miss some of the move

When to Exit

Clear signals the Opening Rip is ending:

- Break below opening 5-minute bar low

- Negative TICK readings becoming frequent

- Advancing-declining ratio deteriorating

- Volume drying up on pushes higher

Common Mistakes to Avoid

Chasing After the Move

- Don’t enter after 30+ minutes unless breaking to new highs

- The best risk/reward is in the first 15 minutes

- Late entries often get caught in the reversal

Ignoring Market Breadth

- Opening Rips without breadth support often fail

- Always confirm with advancing-declining issues

- Solo moves in NQ without market support are dangerous

Using Too Tight Stops

- Opening volatility requires wider stops

- Don’t use normal day trading stops

- Account for the increased opening range

Variations of the Setup

Gap and Go

When the market gaps up significantly (1%+) and continues higher

News-Driven Rip

Economic data or Fed announcements at 8:30 AM create opening momentum

Short Squeeze Rip

Heavy short interest gets squeezed at open creating explosive moves

Technical Breakout Rip

Major resistance levels broken in pre-market trigger continuation at open

Psychology Behind the Setup

The Opening Rip works because it represents maximum emotional intensity:

- Overnight traders rushing to adjust positions

- Shorts panicking to cover at any price

- FOMO buyers afraid of missing the move

- Institutional money deploying capital aggressively

This emotional surge creates the explosive price action, but it’s unsustainable beyond the first hour, which is why timing is critical.

Historical Precedents

Below are 3 historical examples of this setup occurring in NQ futures. Each example shows the setup formation and execution.