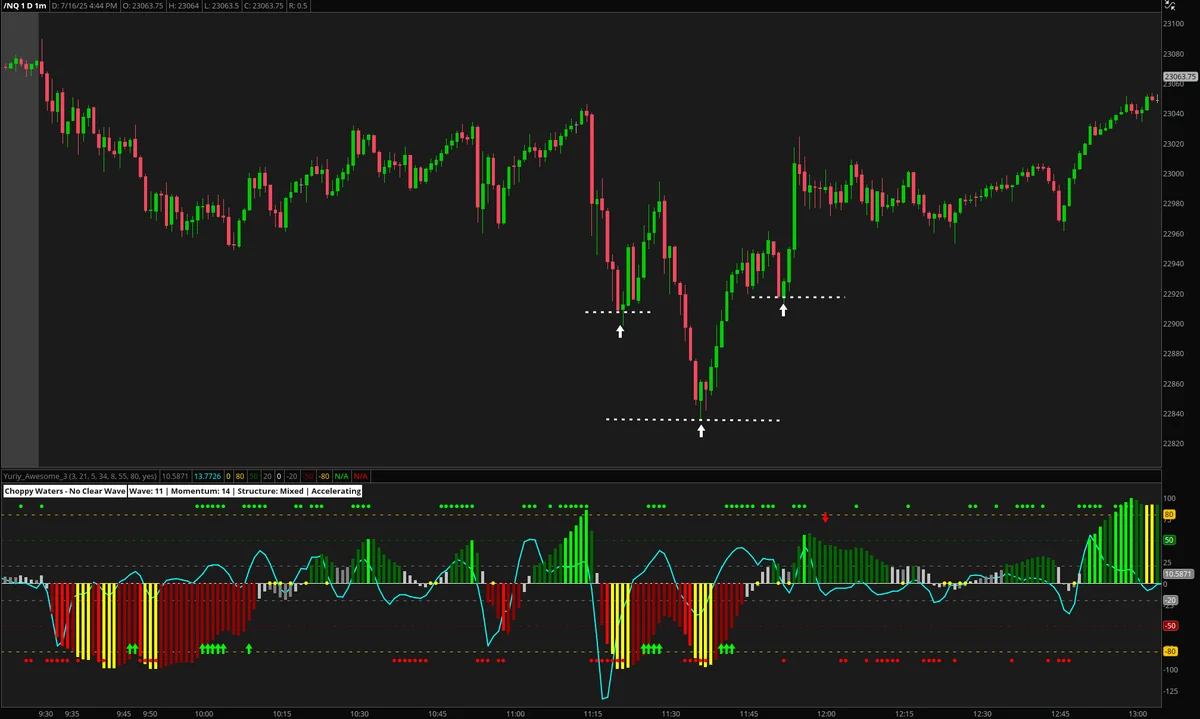

Setup Example

Setup Conditions

Primary Pattern Formation

- Inverse Head & Shoulders: Price forms the characteristic three-trough pattern with the middle trough (head) being the lowest point

- Key Support Level: Pattern must form at or near significant support that spans multiple days or weeks

- Bull Market Context: Setup occurs during strong bull market conditions when NQ is retracing from recent highs

Entry Triggers

- Aggressive Bounce: Price begins to bounce aggressively from the right shoulder area

- Triple AO Wave Rider Signal: The indicator shows clear buy signals confirming the bounce

- Momentum Shift: Triple AO Wave Rider confirms shift from selling pressure to buying momentum

Technical Confirmations

- Triple AO Wave Rider Buy Signals: The indicator must show clear buy signals (green arrows or wave confirmations) aligning with the pattern formation

- Momentum Shift: Triple AO Wave Rider confirms the shift from negative to positive momentum

- Support Hold: The established support level holds firm during the pattern formation

- Wave Analysis: The Triple AO Wave Rider’s three-wave system should align bullishly

Trading Applications

Entry Strategy

Position entry should occur when the price begins its aggressive bounce from the right shoulder area, confirmed by Triple AO Wave Rider buy signals. Look for the indicator to show green arrows or positive wave crossovers, indicating that momentum has shifted in favor of buyers. The combination of the classic pattern and the Triple AO Wave Rider’s momentum confirmation creates a high-probability entry point.

Risk Management

Place stop-loss orders below the head (lowest point) of the pattern, as a break below this level invalidates the bullish setup. The well-defined pattern structure makes risk management straightforward and effective.

Profit Targets

Target levels should be based on the pattern’s height projected upward from the neckline break, with additional consideration for nearby resistance levels that may provide natural profit-taking areas.

Market Context Considerations

This setup is most effective during strong bull market conditions when institutional buyers are likely to support key levels. The pattern’s reliability increases when it forms at support levels that have been respected over longer timeframes.

Key Success Factors

| Factor | Description |

|---|---|

| Pattern Recognition | Correctly identifying the inverse head and shoulders formation with clear left shoulder, head, and right shoulder |

| Triple AO Wave Rider Confirmation | Waiting for clear buy signals from the indicator before entering positions |

| Support Significance | Ensuring the pattern forms at truly important support levels with historical significance |

| Wave Momentum | Understanding how the Triple AO Wave Rider’s three-wave system confirms the bullish reversal |

| Timing | Entering when both the pattern and Triple AO Wave Rider align for maximum probability |

| Market Environment | Trading this setup primarily in strong bull market conditions when buying interest is high |

The Inverse Head & Shoulders setup offers traders a systematic approach to identifying high-probability long entries in NQ futures, combining classical technical analysis with the Triple AO Wave Rider’s momentum confirmation for improved success rates.

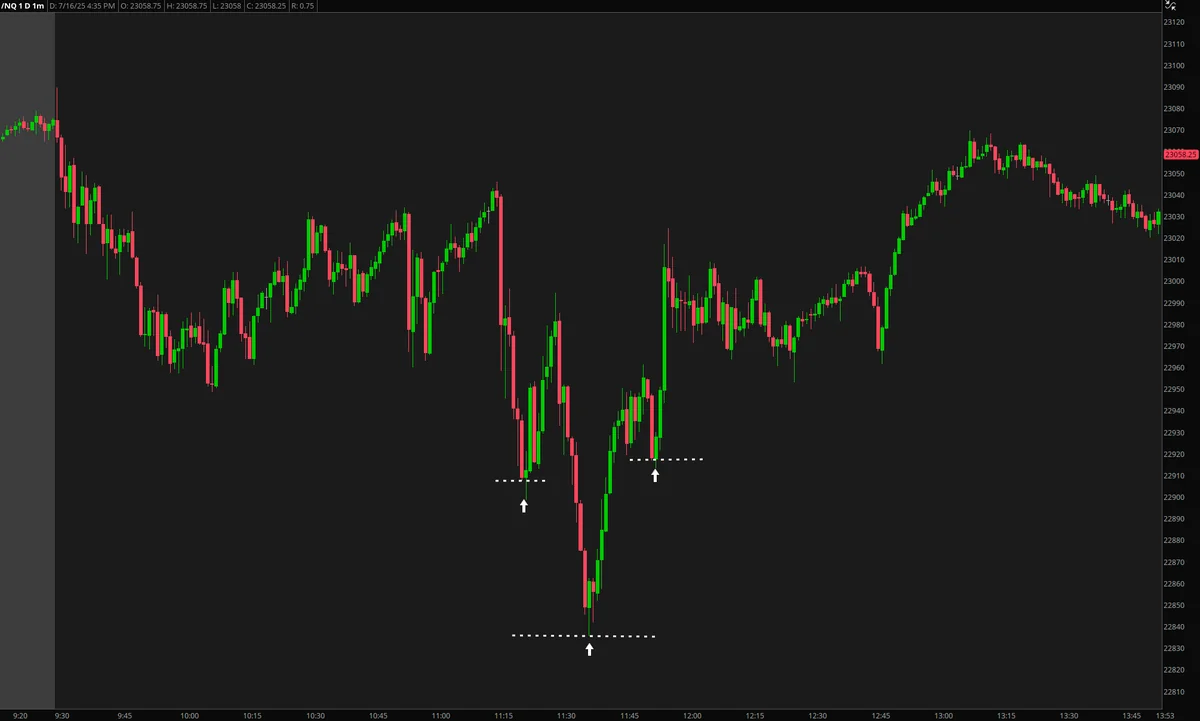

Historical Precedents

Below are 1 historical examples of this setup occurring in NQ futures. Each example shows the setup formation and execution.