Market Overview: A Tale of Two Sessions

July 31st, 2025 will be remembered as a day when euphoria turned to concern in a matter of hours, delivering crucial lessons about market structure, institutional behavior, and the importance of technical levels in futures trading. What began as a celebration of strong earnings from two of technology’s biggest names – Microsoft and Meta – morphed into a stark reminder that positive fundamentals alone cannot overcome technical resistance and institutional distribution.

The Overnight Euphoria

The stage was set during yesterday’s after-hours session when both MSFT and META reported earnings that exceeded Wall Street’s already optimistic expectations. Microsoft showcased robust cloud growth and AI monetization, while Meta demonstrated impressive user engagement and advertising strength. The market’s initial reaction was swift and decisive – NQ futures exploded higher, gapping up significantly in overnight trading.

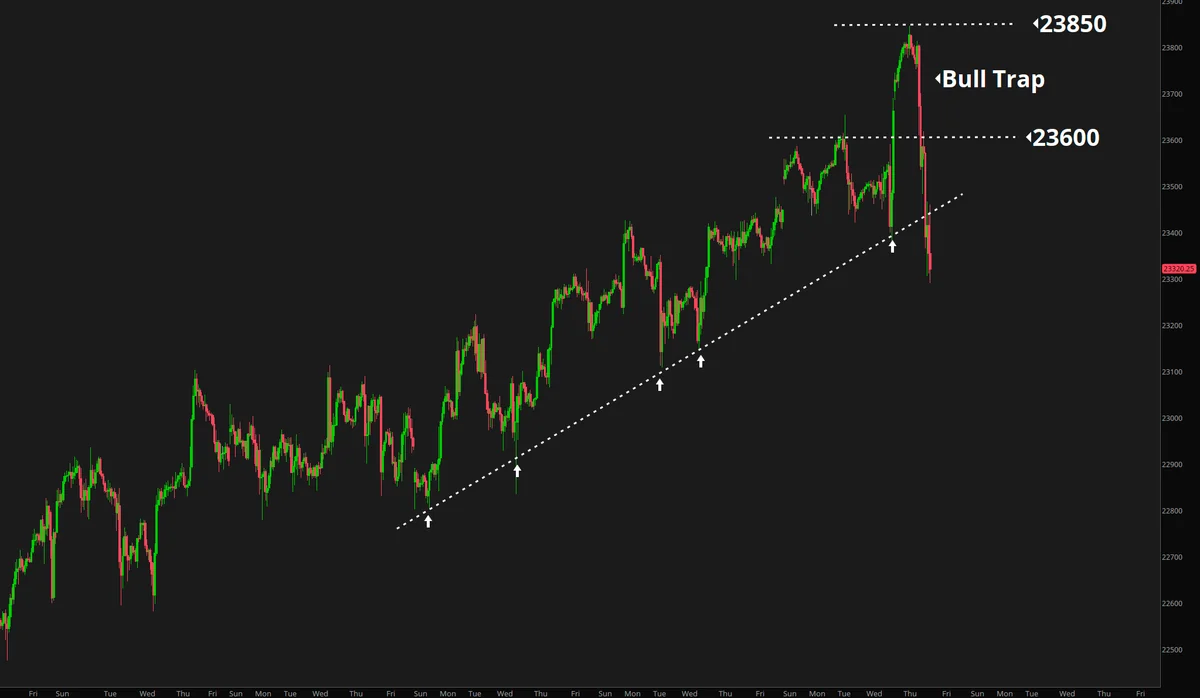

By the early morning hours of July 31st, NQ had surged toward the 23,850 level, approaching critical long-term resistance that had capped previous rallies. The financial media was ablaze with bullish commentary, and retail traders positioned themselves for what appeared to be an inevitable breakout. Social media sentiment reached extreme bullish levels, with many traders expecting the positive momentum to carry through the regular session.

The Institutional Reality Check

However, as seasoned traders know, the overnight session and regular trading hours often tell different stories. When the opening bell rang at 9:30 AM EST, a dramatically different narrative began to unfold. Instead of continuation buying, massive selling pressure emerged immediately. This wasn’t random profit-taking – it was systematic, coordinated institutional distribution.

Large funds, which had likely been scaling into positions during the recent uptrend, saw the earnings-driven gap as an ideal exit opportunity. The selling was relentless and methodical, overwhelming the retail buying interest that had dominated the overnight session. Within the first hour of trading, it became clear that this wasn’t going to be the breakout day bulls had anticipated.

Market Psychology at Play

Today’s price action revealed fascinating insights into market psychology and the ongoing battle between different market participants:

Retail Enthusiasm vs. Institutional Pragmatism: While retail traders were swept up in the earnings euphoria, institutional traders took a more pragmatic approach. They recognized that the market had traveled far and fast, and the earnings gap provided liquidity to exit positions without moving the market against themselves.

FOMO to Fear: The emotional journey from fear of missing out (FOMO) in the overnight session to outright fear during regular trading hours exemplifies how quickly sentiment can shift in futures markets. Traders who were euphoric at 8 AM were in panic mode by noon.

The Smart Money Tell: The fact that such positive earnings news was met with aggressive selling suggests that “smart money” had already positioned for the earnings and was using the news to distribute. This is a classic “buy the rumor, sell the news” scenario playing out in real-time.

Implications for the Days Ahead

As we close out July and prepare for August trading, today’s session has set up several critical questions that the market must answer:

- Was this a one-day profit-taking event, or the beginning of a larger correction?

- Can NQ quickly reclaim the 23,600 level, or will it now serve as resistance?

- Will the technical damage attract more sellers, or will dip buyers emerge?

- How will other tech earnings be received if even strong results from MSFT and META couldn’t sustain a rally?

The answers to these questions will likely emerge in the first few sessions of August, making the coming days crucial for determining the market’s intermediate-term direction. Traders must remain nimble and respect the technical levels that have been established by today’s dramatic price action.

What Happened: The Setup and Reversal

Pre-Market: Earnings-Driven Rally

Yesterday’s after-hours session brought strong earnings results from two major tech giants:

- Microsoft (MSFT): Beat expectations across key metrics

- Meta (META): Delivered solid results driving tech optimism

These positive earnings catalysts sent NQ futures exploding higher overnight, creating significant bullish momentum heading into the 9:30 AM EST market open.

Market Open: The Trap Springs

Despite the overnight strength, the session took a dramatic turn immediately after the opening bell:

- Initial Weakness: NQ began dropping from pre-market highs

- Institutional Selling: Large funds started taking profits on the overnight gap

- Bull Trap Formation: NQ decisively broke below the critical 23,600 level

- Extended Decline: Price pushed even lower than yesterday’s session lows

The chart above shows the clear bull trap formation as NQ broke below both the 23,600 support level and yesterday’s lows, falling beneath the diagonal support line that had been providing structural support.

Technical Analysis: What the Charts Tell Us

The Weekly Perspective

Looking at the longer-term weekly chart provides crucial context for today’s price action:

The weekly chart reveals several important observations:

- Breakout Attempt: NQ attempted to break above long-term resistance during pre-market hours

- Rejection: Today’s bearish reversal brought price back below the resistance line

- Critical Juncture: We’re at a make-or-break level for the longer-term bull trend

Key Technical Levels

Understanding the critical levels is essential for navigating the coming sessions:

Support Levels:

- 23,600: The primary support that was broken today (now resistance)

- Yesterday’s Lows: Additional support that was also violated

- Diagonal Support: The uptrend line that provided structural support

Resistance Levels:

- 23,600: Now overhead resistance after being broken

- 23,850: Today’s pre-market high - crucial resistance to reclaim

- Long-term Resistance: The weekly resistance line visible on the higher timeframe

Market Context: Bull Trap vs. Trend Reversal

What Bull Traps Signal in Bull Markets

It’s crucial to understand that bull traps in strong bull markets don’t automatically signal major tops. Instead, they often represent:

- Profit-taking episodes: Institutional investors securing gains

- Healthy corrections: Normal pullbacks in trending markets

- Re-accumulation phases: Smart money preparing for the next leg higher

- Sentiment resets: Clearing out weak hands and excessive optimism

The Institutional Perspective

Today’s price action showed classic institutional behavior:

- Gap Fade Strategy: Taking profits on overnight gaps

- Earnings Fade: Selling strength after earnings announcements

- Technical Selling: Triggering stops below key support levels

- Volume Confirmation: Heavy selling volume confirming the move

Scenarios for Early August

As we close out July, several scenarios are possible for early August trading:

Scenario 1: Quick Recovery (Bullish)

Probability: Moderate to High

Key Triggers:

- NQ quickly reclaims 23,600 within 1-2 sessions

- Strong buying emerges at current levels

- Broader tech earnings continue to support sentiment

Trading Implications:

- Today’s drop becomes a buying opportunity

- Previous resistance becomes support again

- Bull trend resumes with renewed strength

Scenario 2: Extended Consolidation (Neutral)

Probability: High

Key Triggers:

- NQ trades in a range between current levels and 23,600

- Mixed earnings results create choppy conditions

- Volume remains moderate without conviction

Trading Implications:

- Range-bound trading for several sessions

- Opportunities on both sides of the range

- Patience required until directional clarity emerges

Scenario 3: Deeper Correction (Bearish)

Probability: Lower but Possible

Key Triggers:

- Failure to reclaim any meaningful resistance

- Additional negative catalysts emerge

- Technical breakdown below multiple support levels

Trading Implications:

- More significant pullback possible

- Lower timeframe opportunities on short side

- Look for oversold bounces to sell into

What to Watch: Critical Levels and Timeframes

Immediate Focus (1-3 Sessions)

23,600 Reclaim: The most critical level to watch

- Above: Suggests bull trap was just profit-taking

- Below: Indicates potential for deeper correction

Volume Analysis:

- Strong volume on any reclaim attempt = bullish

- Weak volume rallies = distribution/selling

Short-term Focus (1-2 Weeks)

23,850 Resistance: The pre-market high from today

- Breaking above confirms strength resumption

- Rejection suggests more consolidation needed

Weekly Chart Behavior:

- How price closes relative to weekly resistance

- Whether we see follow-through or stalling

Medium-term Focus (August)

Broader Market Context:

- Tech earnings season continuation

- Economic data and Fed policy implications

- Seasonal patterns and flow considerations

Conclusion: Patience and Preparation

Today’s bull trap formation following strong MSFT and META earnings serves as a reminder that even positive catalysts can lead to unexpected price action when institutional profit-taking dominates. The key is not to predict what will happen, but to prepare for multiple scenarios and react appropriately to price action.

Key Takeaways:

- Bull traps in bull markets are often profit-taking, not trend reversals

- 23,600 is the critical level - watch how NQ behaves around it

- Early August will be decisive for determining the next directional move

- Risk management is paramount during uncertain periods

As we enter August, focus on what the market is telling you through price action rather than trying to predict outcomes. The levels are clearly defined, and the scenarios are mapped out. Now it’s time to let the market show its hand and react accordingly.