Monday’s session presented a fascinating study in contrarian trading psychology. While the market showed a persistently bearish bias throughout the session, it simultaneously offered one of the best dip buying opportunities we’ve seen in recent weeks. This apparent contradiction highlights a fundamental truth in futures trading: sometimes the best long opportunities emerge from the depths of market pessimism.

Market Context: Strength Within Weakness

NQ has been on an impressive run since the April lows, recently printing new all-time highs. In such environments, attempting to short on rebounds typically proves to be a costly endeavor. However, buying weakness in a strong trending market can yield exceptional risk-adjusted returns when executed with proper timing and confluence.

Monday’s session saw NQ drop significantly from the session highs, creating an oversold condition that savvy traders could exploit. The key was recognizing when bearish sentiment had reached extremes and positioning for the inevitable bounce.

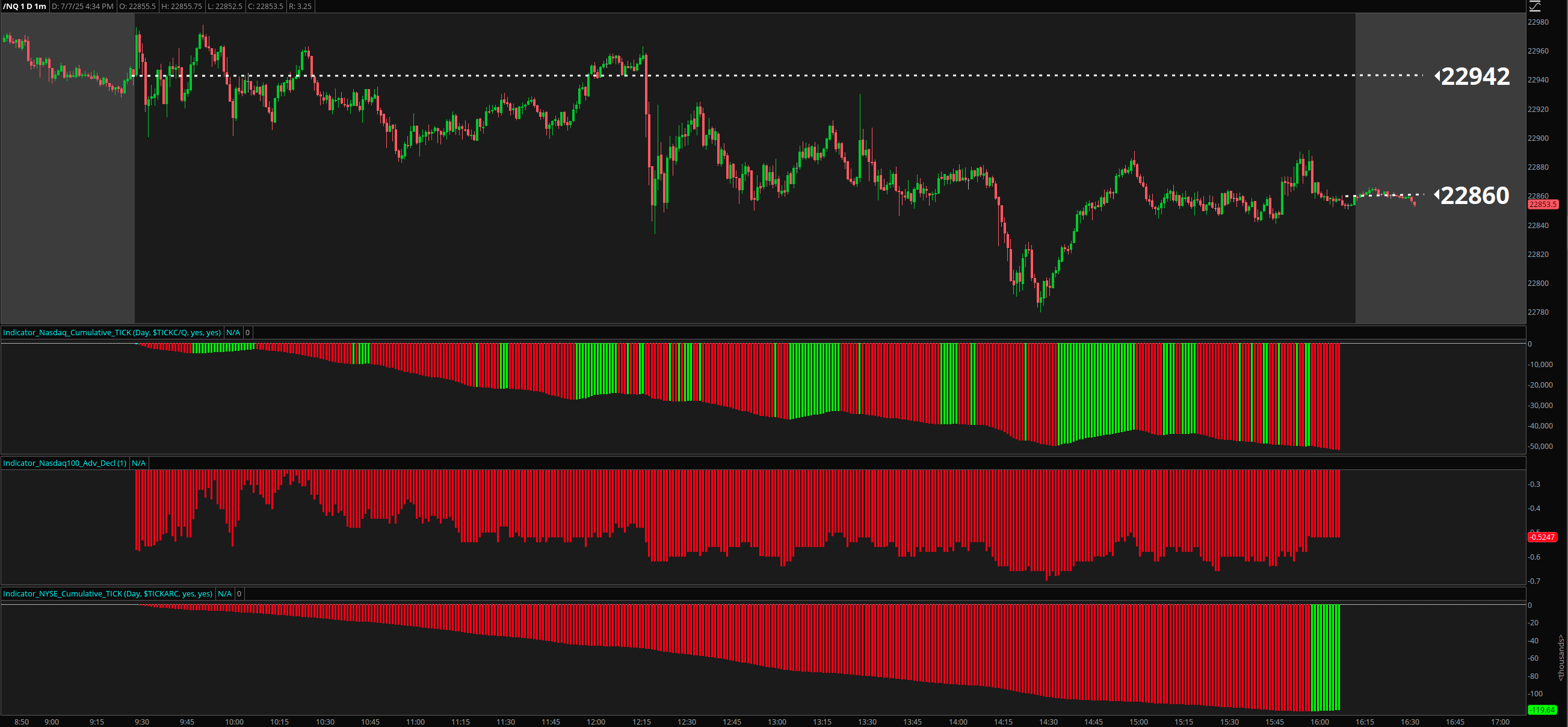

Market Breadth: The Bearish Story Unfolds

Throughout the session, multiple market breadth indicators painted a consistently bearish picture, confirming the underlying weakness:

Cumulative TICK: Sustained Selling Pressure

The Cumulative TICK indicator, which tracks the flow of upticks versus downticks across NYSE stocks, trended downward for the entire session. This persistent negative divergence indicated that selling pressure was broad-based and sustained, not limited to just the tech-heavy NQ.

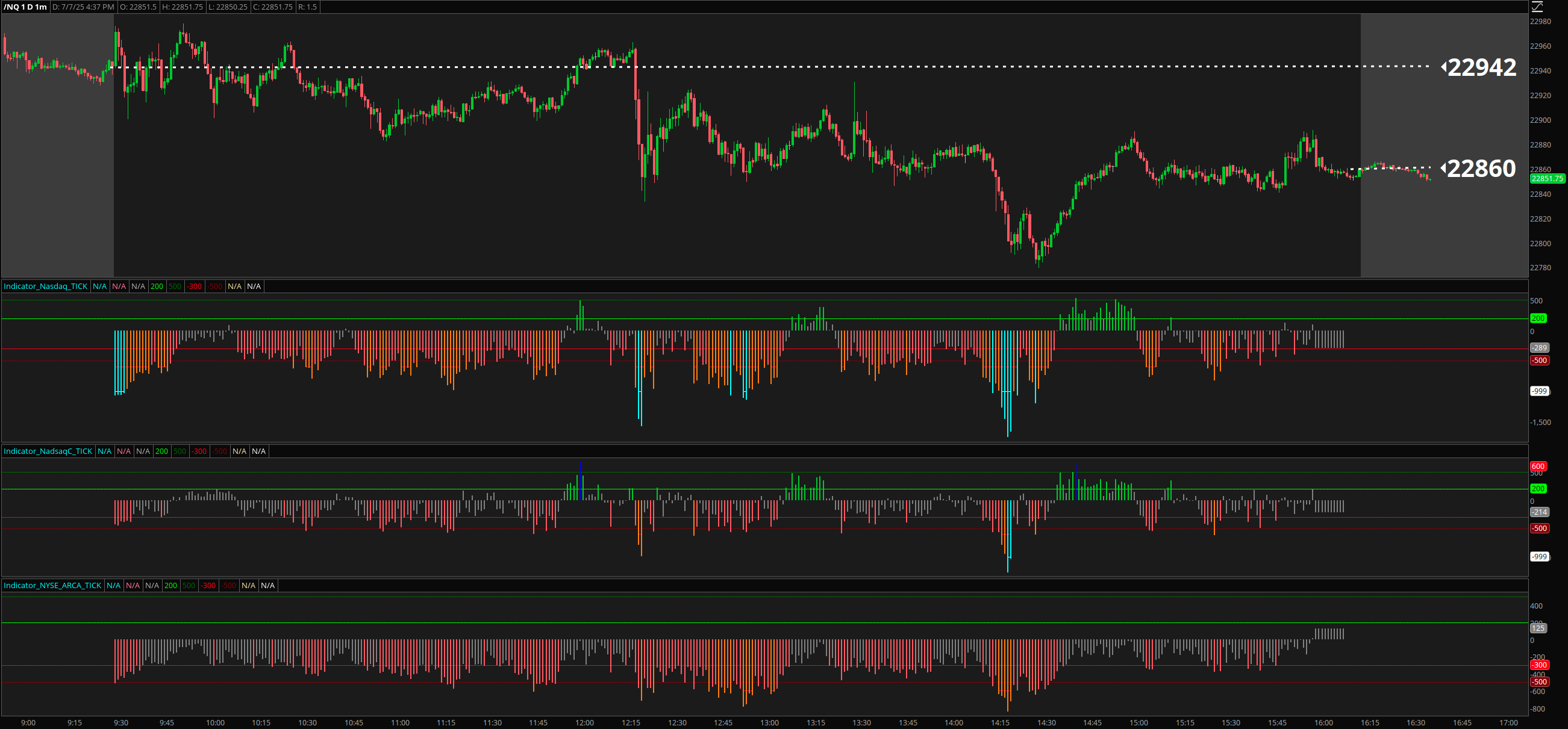

TICK Sentiment Zones: Below Zero Territory

Our TICK sentiment zones analysis revealed predominantly negative readings throughout the session. When TICK consistently trades below zero, it signals that more stocks are trading on downticks than upticks, confirming the bearish undertone across the broader market.

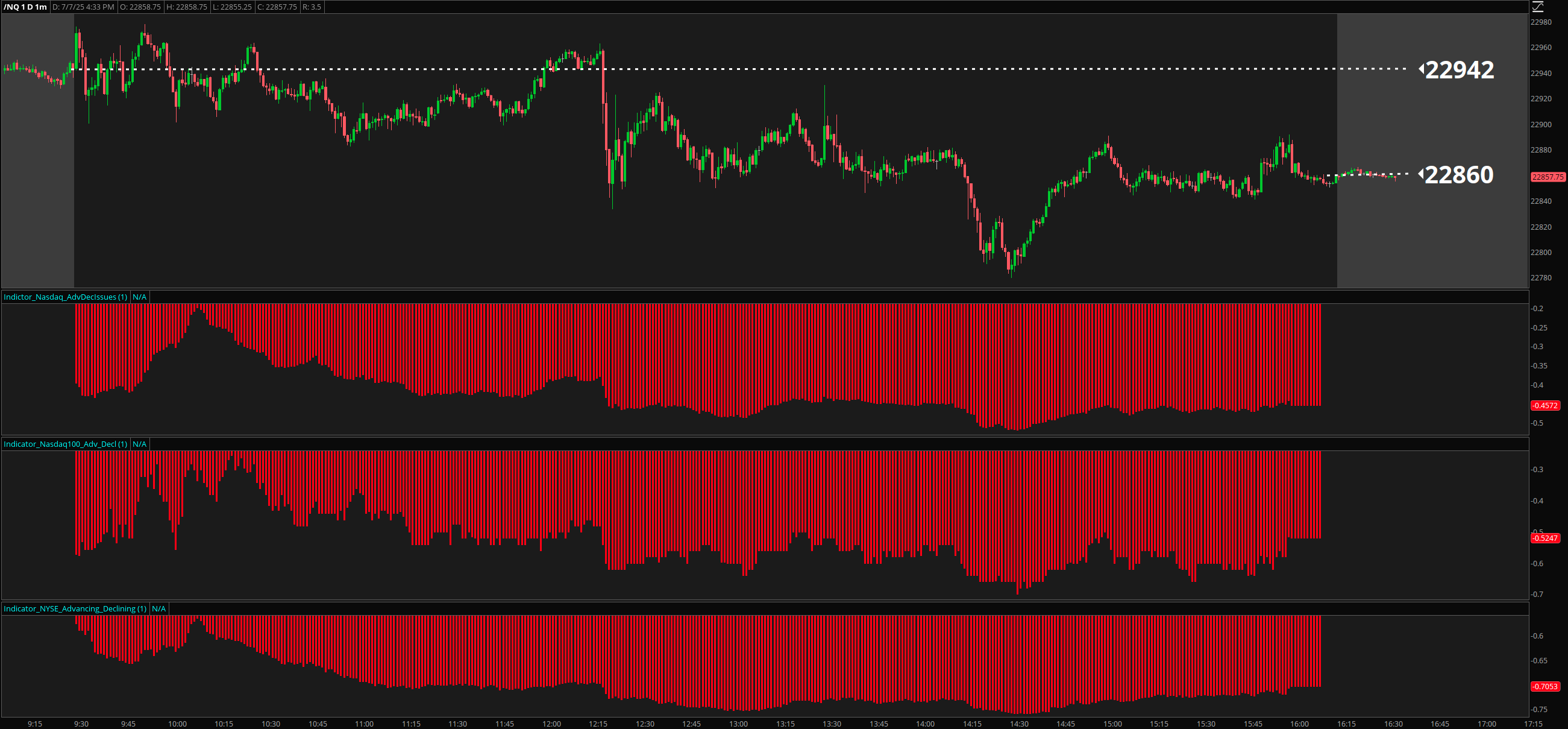

Advancing vs. Declining Issues: Clear Divergence

The advance-decline data told a compelling story of market weakness. Declining stocks significantly outnumbered advancing stocks, creating a negative breadth environment that supported the bearish bias we observed in price action.

Volume Participation: Money Flowing to the Downside

Perhaps most telling was the volume analysis showing higher participation in declining stocks. When volume flows predominantly into declining issues, it suggests institutional selling pressure rather than mere retail profit-taking.

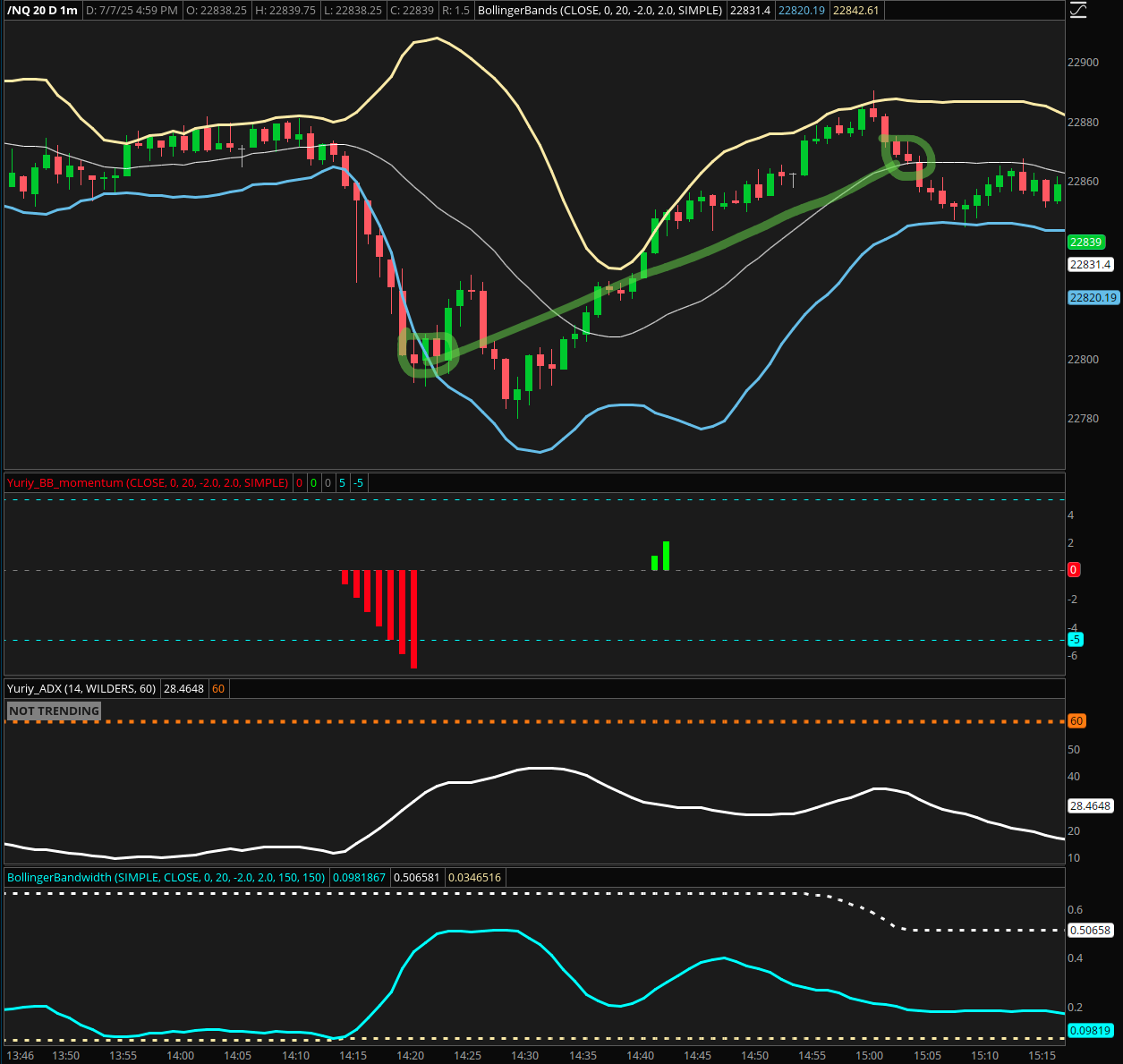

Identifying the Reversal Setup

As the session progressed toward its close, the market began showing signs of extreme oversold conditions—precisely the environment where experienced dip buyers begin to take notice.

Bollinger Band Penetration Strategy

One of the primary oversold indicators focuses on Bollinger Band penetration patterns. When price drops below the lower Bollinger Band and remains there for 4-5 consecutive candles (as we saw Monday), it often signals an oversold condition ripe for mean reversion.

The extended stay below the lower band, combined with the other confluence factors, created a high-probability bounce setup that aligned with our contrarian thesis.

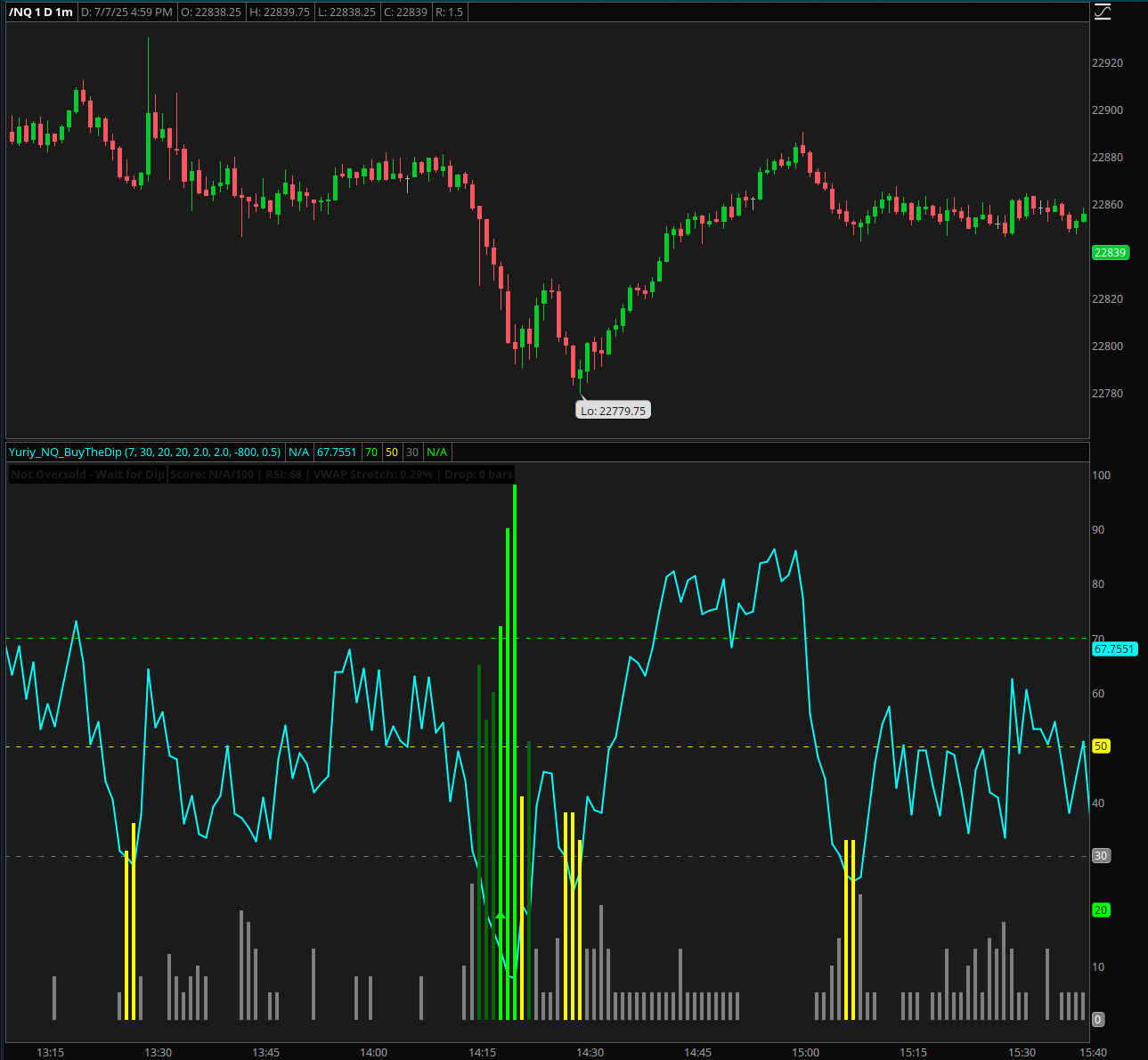

Custom “Dip Buyer” Indicator: Multi-Factor Analysis

The proprietary “Dip Buyer” indicator provided the final confirmation for this trade setup. This powerful oscillator combines eight distinct oversold conditions into a composite score, creating what we call a “confluence detector.”

What Makes This Indicator Unique:

The Dip Buyer indicator synthesizes the following oversold conditions:

- RSI oversold levels - Traditional momentum exhaustion signals

- Bollinger Band penetration - Statistical price deviation measures

- VWAP stretch - Distance from volume-weighted average price

- Volume spike analysis - Unusual volume on down moves

- Consecutive down bars - Momentum persistence tracking

- Intraday percentage drop - Magnitude of decline measurement

- TICK extremes - Market breadth confirmation

- Rate of descent - Speed of price deterioration

Rather than relying on a single indicator, this multi-factor approach waits for multiple oversold conditions to align simultaneously, significantly increasing the probability of a successful bounce trade.

When the indicator flashed its highest oversold reading of the session, it provided the confirmation needed to execute the dip buying strategy.

Trade Execution: Scaling and Risk Management

Given the session’s pronounced bearish bias, this opportunity required a specific execution approach focused on quick scalping rather than swing positioning.

Position Sizing Strategy

The position started with 3 NQ contracts, allowing for quick assessment of market response. Upon seeing immediate positive price action, it was scaled up to 10 contracts to maximize the opportunity while the setup remained intact.

Profit Taking Protocol

The exit strategy was equally important as the entry. After NQ rallied approximately 50 points from the entry level, position size began systematic reduction. The final contracts were liquidated when price dropped back below the Bollinger Band middle line, signaling potential loss of momentum.

This disciplined approach to both scaling in and scaling out allowed for better risk-reward ratios while respecting the overall bearish context of the session.

Key Takeaways for Dip Buyers

- Respect the trend - In strong trending markets, focus on buying weakness rather than shorting strength

- Wait for confluence - Multiple oversold indicators provide higher probability setups than single-factor analysis

- Scale intelligently - Start small and add to winners while maintaining strict risk parameters

- Exit with discipline - Take profits systematically and respect predetermined exit signals

Monday’s session showed how market weakness can create exceptional opportunities for prepared traders. By combining technical analysis with market breadth insights and custom indicators, we transformed a bearish session into a profitable trading opportunity.

The key is maintaining the patience to wait for extreme conditions and the discipline to execute when multiple factors align. In futures trading, sometimes the best offense is knowing when to play defense—and when market pessimism creates the very opportunities we seek to exploit.

This analysis represents actual trading setups and results from Monday’s NQ session. All trades involve risk, and past performance does not guarantee future results. Proper risk management and position sizing are essential components of any trading strategy.